Lido is a decentralized staking platform that offers staking services for Ethereum, Luna, Solana and Kusama. Lido provides liquidity services for staked assets. What is this all about? What's special about Lido? We are going to answer all your questions and guide you on how to stake your ETH on Lido.

Ethereum as we know is a decentralized smart contract platform. Due to the rapid increase in decentralized applications and the number of active users on Ethereum, the platform is often congested, and transactions are not so fast. Ethereum certainly has some scalability issues. This is where Ethereum 2.0 comes in.

What is Ethereum 2.0?

Ethereum 2.0 is an upgrade to the current version of Ethereum which aims to improve the scalability of Ethereum. The current version of Ethereum uses Proof-of-Work consensus that consumes a lot of energy and is not environmental-friendly.

Ethereum 2.0 is going to use Proof-of-Stake consensus where users stake their ETH to validate and process the transactions in the network. Users earn staking rewards for staking their ETH. But the problem here is, that users have to stake a minimum of 32 ETH which is more than $110,000 at the time of writing this article. Users won't be able to withdraw their staked ETH until Ethereum 2.0 goes live which is expected to happen in June 2022. Not only that but staking on Ethereum 2.0 requires expert knowledge and complex infrastructure. Lido makes all these things easier for you.

How Do Lido Solve ETH 2.0 Staking Problems?

Lido solves the minimum staking problem and also provides liquidity to their staked ETH. Users can stake any amount of ETH and earn staking rewards. For every ETH staked on Lido, users can redeem stETH on a 1:1 ratio. stETH can be traded, and transferred and can also be used across decentralized applications.

Lido is the biggest Ethereum staking pool. More than $21 billion worth of assets and over 3,000,000 ETH are staked with Lido. Over 94,000 users have staked their assets on Lido. The current APR for staking ETH on Lido is 3.9%. This number is expected to go up after the Ethereum 2.0 upgrade.

Lido is open-source and enables non-custodial staking. Lido also stakes ETH across multiple validators to minimize risk and improve uptime. Lido is one of the most secure platforms.

So you can stake any amount of ETH on Lido. You can redeem assets pegged to your staked assets to earn additional yield across defi platforms. You can also use your tokens as collateral to lend and borrow other tokens. Staking on Lido also enables you to participate in the governance of the platform. LDO token grants governing rights to the Lido DAO

Staking ETH on Lido

Here is the step-by-step guide to staking your ETH on Lido

1. Go to the ETH staking page on Lido

2. Click on 'Stake Ethereum'

3. On the next staking page, click on 'Connect Wallet' to connect your Ethereum wallet

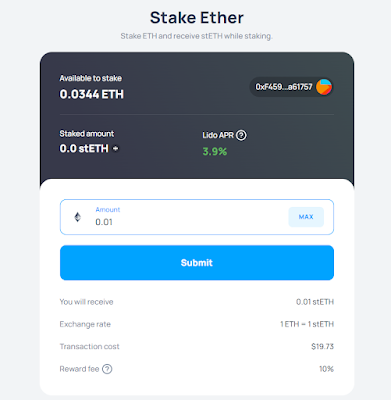

4. Enter the amount of ETH you want to stake and click 'Submit'. Confirm the transaction in your wallet

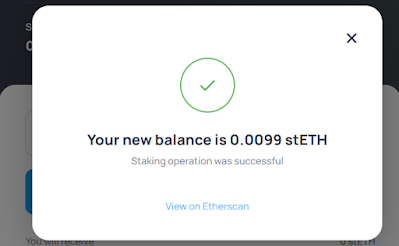

5. Now you have successfully staked ETH on Lido and the same amount of stETH will be deposited into your wallet

6. Go to the 'Rewards' tab to check your stETH balance, stETH earned and the APR at which you are earning, and also your staking and reward history

So now your ETH is not stuck in the Ethereum 2.0 contract. You are free to transfer and trade your stETH whenever you want. stETH has the same price as ETH. You can also provide stETH as collateral to borrow stable coins and earn additional APR on them.

Post a Comment