Michael Saylor was the CEO of MicroStrategy when they have adopted the Bitcoin strategy. Michael Saylor has been an advocate of Bitcoin since 2020 and it has been a great win for him and his company.

In a recent interview, he has mentioned that he owns about $1 billion worth of Bitcoin personally. Currently, he is the Executive Chairman of MicroStrategy and under his leadership, the company has transformed itself into one of the biggest corporate holders of Bitcoin globally.

MicroStrategy's Bitcoin Strategy

MicroStrategy, a business intelligence company, has made a significant strategic shift by investing heavily in Bitcoin. Starting in August 2020, the company began purchasing large amounts of Bitcoin, initially investing $250 million. This strategy represents a significant shift from traditional corporate treasury management, where companies typically hold cash or other liquid assets.

Michael Saylor argued that the increasing money supply and rising inflation posed significant risks to cash reserves, making Bitcoin's finite supply and decentralized nature an attractive alternative.

Bitcoin's digital properties make it a better store of value compared to traditional assets like gold. Its portability, divisibility, and security are seen as critical advantages. MicroStrategy aims to benefit from the network effect as more institutions and individuals adopt the cryptocurrency, potentially driving up its value.

Execution of the Master Plan

The company has committed to continually acquiring Bitcoin, using both excess cash and funds raised through capital markets.

By early 2021, MicroStrategy had acquired over 90,000 Bitcoins, valued at billions of dollars. As of June 30, 2024, MicroStrategy holds 226,331 bitcoins acquired at an average price of $36,798 and at the time of writing this article, those holdings are worth over $14 billion dollars and they are up over 70% on their Bitcoin investment.

This aggressive accumulation was financed through various means, including convertible senior notes, which allowed the company to raise capital at low-interest rates while offering investors the option to convert their notes into MicroStrategy shares.

After the initial $250 million purchase, MicroStrategy continued to use its cash reserves for additional Bitcoin acquisitions. For instance, the company made a second purchase in September 2020, acquiring an additional $175 million in Bitcoin, again using its cash on hand.

To further scale up its Bitcoin holdings without depleting its cash reserves entirely, MicroStrategy turned to the capital markets. Starting in December 2020, the company issued its first round of convertible senior notes, raising approximately $650 million.. In February 2021, MicroStrategy issued another round of convertible notes, this time raising about $1.05 billion. They have raised additional $900 million in 2021 to buy more Bitcoin.

MicroStrategy raised $205 million loan backed by a portion of MicroStrategy’s existing Bitcoin holdings to finance the purchase of more Bitcoin in March 2022.

In September 2022, MicroStrategy announced an agreement with Cowen and Company and BTIG to sell up to $500 million of Class A common stock over time. This equity sale was part of a broader strategy to raise funds that could be used for general corporate purposes, including the purchase of more Bitcoin.

In March 2024, MicroStrategy announced the issuance of $600 million in convertible senior notes which the company intended to use the net proceeds from the sale of the notes to acquire additional Bitcoin. They ended up raising $782 million from this offering, which they used to purchase 12,000 BTC at an average price of $65,883 per BTC. And in June 2024, MicroStrategy completed the $800 million note offering to buy more Bitcoin. They acquired an additional 11,931 BTC for $786 million using proceeds from convertible notes and excess cash.

The Rationale Behind the Strategy

- Bitcoin as a hedge against inflation

With central banks increasing the money supply and interest rates remaining low, the company believes that fiat currencies are losing value. Bitcoin's finite supply and decentralized nature make it an attractive alternative to traditional cash reserves.

- Stock Performance

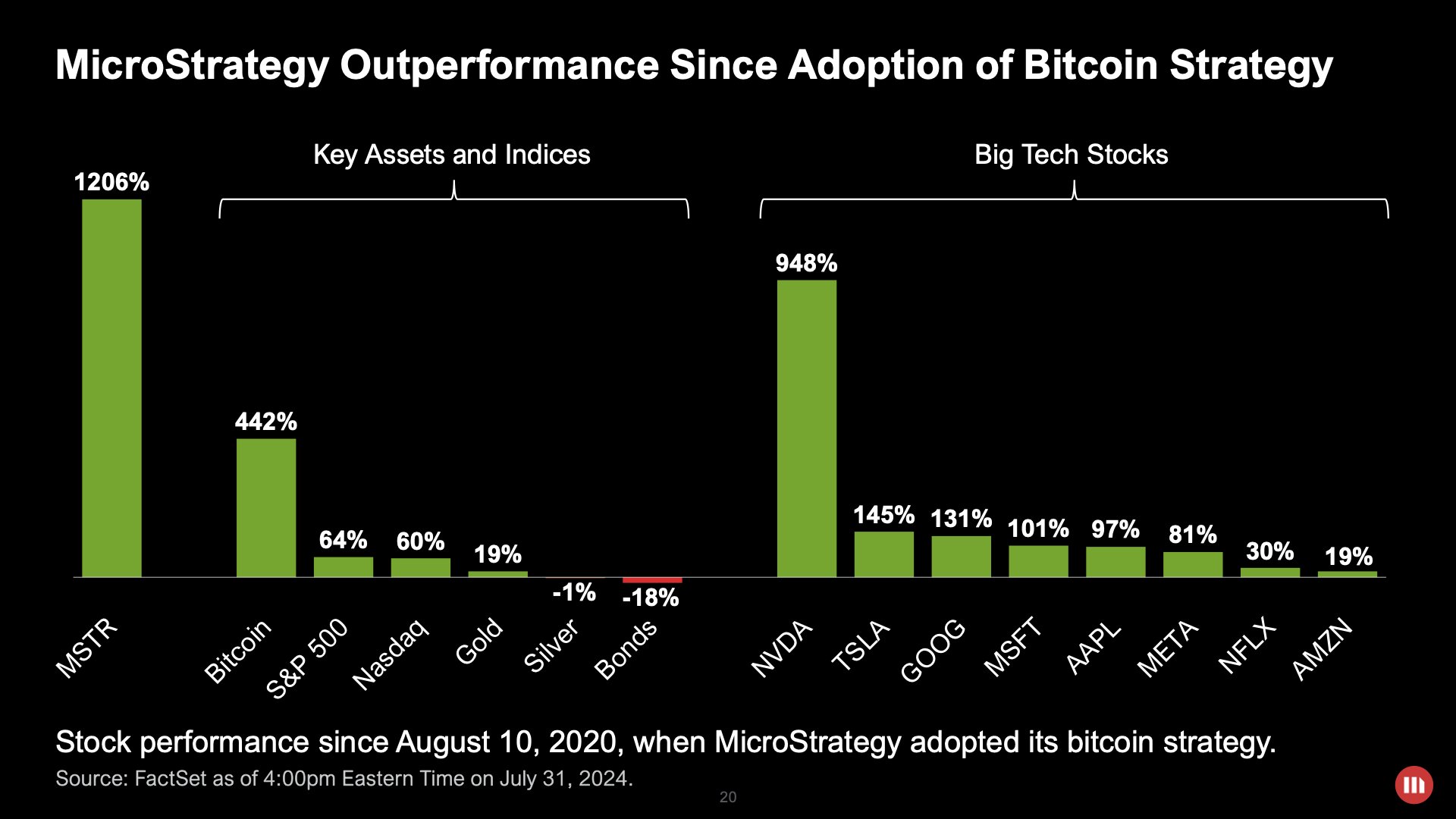

The company's stock price has been highly correlated with Bitcoin's price movements. While this has led to substantial gains. Infact, it has outperformed S&P 500 and even some major tech stocks. Here is the performance of MicroStrategy's stock since they have adopted their Bitcoin strategy on August 10, 2020. This move has immensely benefitted the shareholders of the company.

- Public Perception

Michael Saylor has become a vocal advocate for Bitcoin, frequently speaking at industry conferences and engaging with the media to promote the benefits of Bitcoin adoption. This advocacy has helped to elevate MicroStrategy's profile and influence in the cryptocurrency space.

- Innovation and Forward-Thinking

Adopting Bitcoin can signal to the market that a company is innovative and forward-thinking. This can attract investors and customers who value technological advancement and financial innovation.

Michael Saylor's Presentation at Nashville

Michael Saylor in his presentation at Bitcoin Conference at Nashville, presented about the lifespan of various assets including fiat currencies, art, stocks, mutual funds, hedge funds and real estate. He claims that Bitcoin has the highest lifespan among all these assets.

Michael Saylor in his presentation has given out a prediction on the price of Bitcoin in 2045. He has predicted the price of Bitcoin to be $3 million in Bear case, $13 million in base case, and $48 million per Bitcoin in bullish case. The market cap of Bitcoin in the bear case would be $66 trillion and that means the annual growth rate of Bitcoin would be 21%. He also means that money would flow from real estate, equities and bonds to Bitcoin.

He has also proposed a Bitcoin strategy for individuals, corporates, institutions as well as for foreign nations. He advises that one should have atleast 10% of their wealth in Bitcoin. And also that United States should hold 500,000 bitcoins as a part of their treasury along with Gold/Bonds and US could get rid of its national debt by 2045 if they hold 5.8 million bitcoins.

He also quoted a thought by Satoshi Nakamoto,

It might make sense just to get some in case it catches on. If enough people think the same way, that becomes a self-fulfilling prophecy

Conclusion

MicroStrategy's Bitcoin strategy is a bold experiment at the intersection of technology, finance, and corporate governance. Michael Saylor's vision of Bitcoin as a superior store of value has driven the company to make unprecedented moves in the corporate world, challenging traditional notions of treasury management.

While the long-term outcomes of this strategy remain uncertain, there is no doubt that MicroStrategy has left an indelible mark on the history of Bitcoin and corporate finance. As the world watches closely, the company's journey offers valuable insights into the potential and perils of embracing digital assets at scale.

Post a Comment